Merchant User Flow

Overview

This document will help you get a sense of your users’ experience.

Offramp - API Flow

To depict how a user sells crypto for fiat, including user registration, crypto deposit, and fiat payout via IMPS.

1.User Registration:

-

Merchant ensures the user is registered in Swiftramp.

2.KYC Check:

-

Verify if the user is KYC-approved.

-

If not approved → Redirect to KYC process.

3.Bank Addition:

-

User adds their bank account.

4.User Initiates Offramp:

-

User selects the crypto to sell and the amount.

5.Crypto Conversion:

-

Convert the crypto into fiat currency using real-time conversion rates.

6.Fiat Payout:

-

Fiat is transferred to the user’s bank account.

7.Transaction Completion:

-

Update the transaction status in Swiftramp.

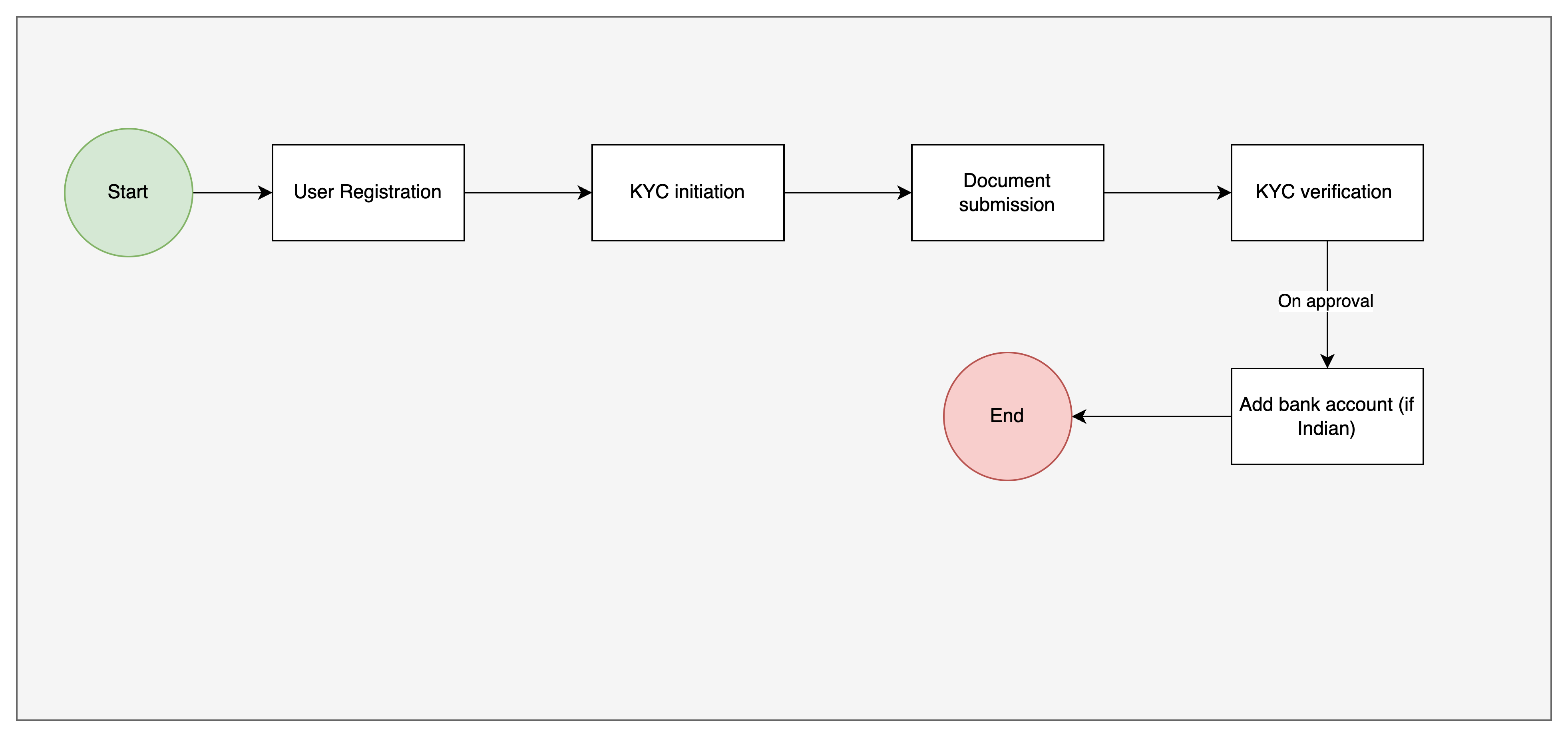

KYC Flow

To show how users are verified for compliance before performing any transactions.

Flowchart

1.User Registration:

-

User is created in the Swiftramp system.

2.KYC Initiation:

-

Via API (Merchant handles verification).

-

Via SDK (Swiftramp handles verification).

3.Document Submission:

-

Users upload necessary documents.

4.KYC Verification:

-

Approved → Proceed to next steps (e.g., add a bank account for Indian users).

-

Rejected → Request re-submission of documents, if applicable.

5.KYC Completion:

-

User status is updated to “KYC Approved.”

Next Steps

Go ahead and check out our quickstart guides.